Tax Resolution Services – Provide Expert Assistance

Tax resolution services in Atlanta are fundamental for people and organizations confronting hardships with the IRS. These services give master

Tax resolution services in Atlanta are fundamental for people and organizations confronting hardships with the IRS. These services give master

When it comes to money matters, things can get tricky quickly. You never know when emergencies arise, or when you

When you need some financial help, the best thing to do is look for loans online instant approval. This type

When you’re strapped for cash, bad credit loans same day can be a lifesaver. Life can be unpredictable, and sometimes

In a hurry for some fast payday loans? A payday loan may be the answer! These loans are designed to

If you are looking for church loans, you must know certain things to follow the process and increase your chance

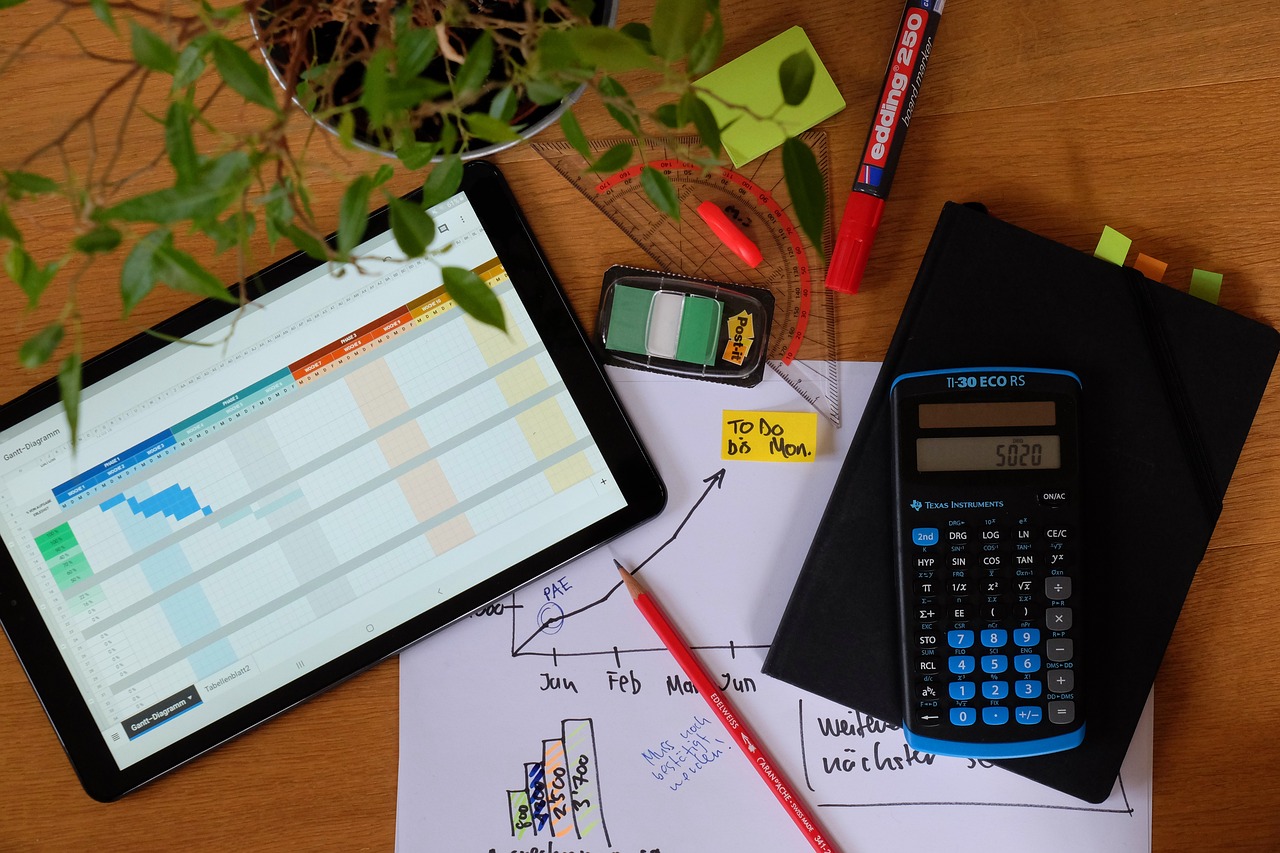

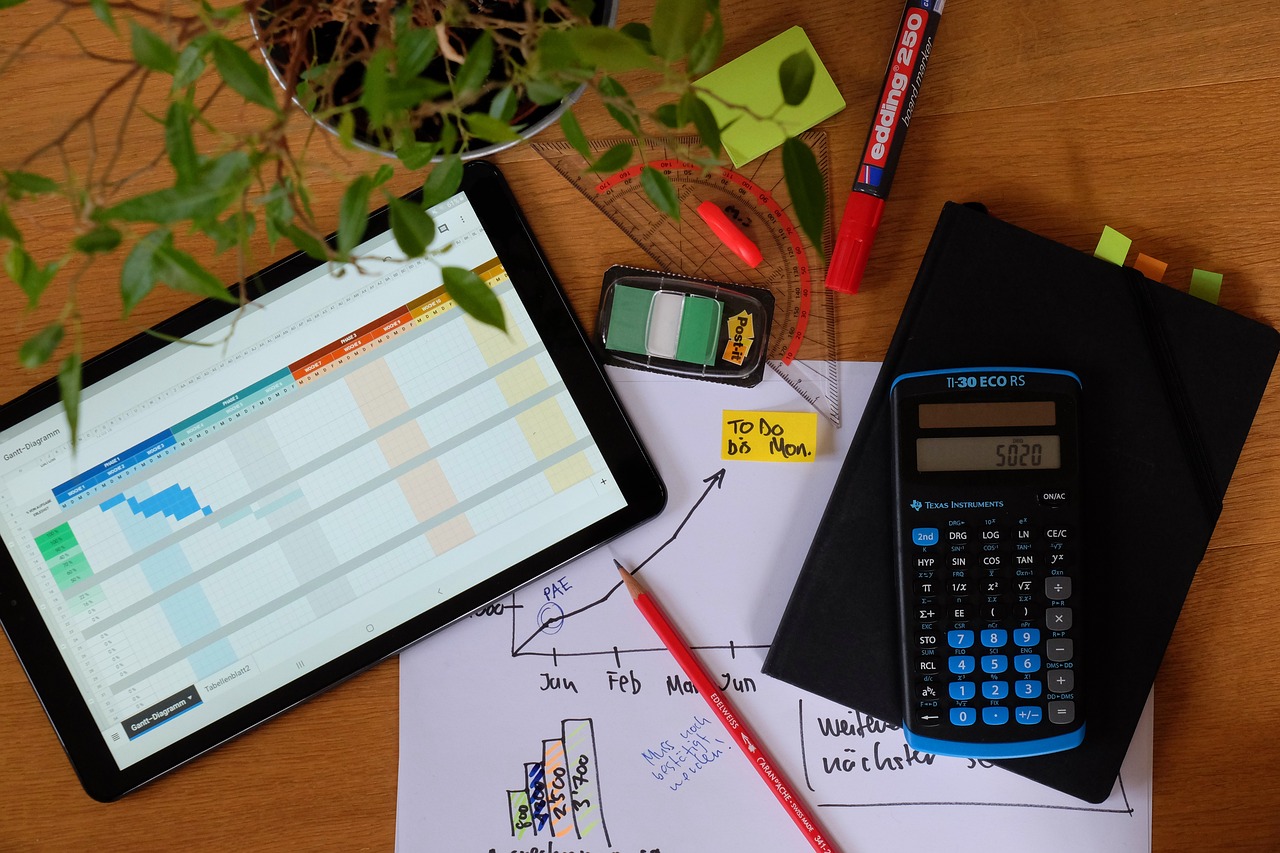

As a business owner, you are constantly juggling various responsibilities. You must manage employees, deal with customer relations, and maintain

Forex trading has become one of the most popular investment options in recent years. With over $5 trillion being exchanged

As a business owner, one of the most crucial aspects of managing your finances is keeping track of your expenses

Are you looking for a new home in Inner West and wondering how to finance it? If so, you may